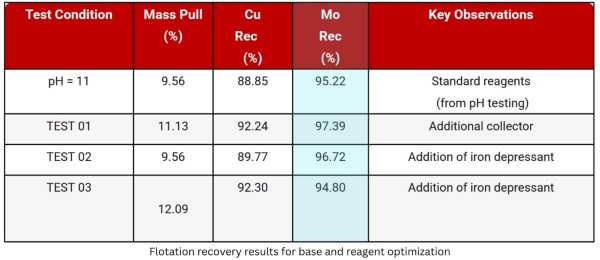

The first metallurgical tests, under laboratory conditions, have already exceeded the recovery assumptions of 90% for copper and 75% for molybdenum used in our current resource model

Canada, 9th Oct 2025 – Global Stocks News – Sponsored content disseminated on behalf of Copper Giant Resources. On October 2, 2025 Copper Giant (TSXV: CGNT) (OTCQB: LBCMF) (FRA: 29H0) announced results from its bench-scale, preliminary metallurgical test work on core from the Mocoa copper-molybdenum project.

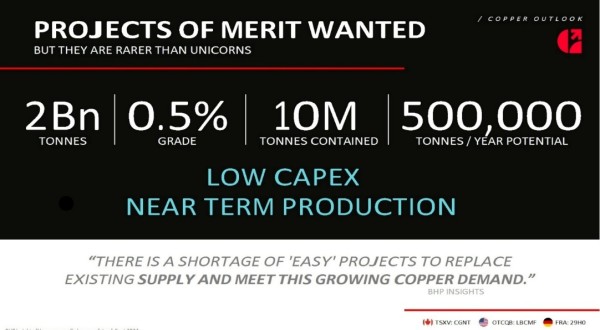

Copper Giant is developing the Mocoa copper-molybdenum porphyry deposit located in Putumayo, Colombia. The company is drilling aggressively to expand a pit constrained resource of 4.6 billion pounds of copper and 511 million pounds of molybdenum [1.].

With more than 500 million pounds of contained molybdenum—representing up to 30% of the project’s value, Mocoa is emerging as one of the largest undeveloped molybdenum deposits in the world.

The company’s district-scale land package covers 1,360 square km² area – 390X bigger than NYC’s Central Park. Mocoa is open in both directions, along strike and at depth.

October 2, 2025 Metallurgy Highlights:

- Initial bench-scale rougher flotation laboratory test results show strong recoveries — up to 92% copper and 97% molybdenum, exceeding the assumptions (90% Cu, 75% Mo) used in the current resource model.

- Grind sizes were relatively coarse with a P80 150–180μm in TIMA analysis. Molybdenum mineralogical analysis shows 97% of molybdenite reported as free grains at P80 150–180μm in TIMA-X (TESCAN Integrated Mineral Analyzer) analysis.

- Copper mineralization is dominated by chalcopyrite, a processing-friendly copper mineral, indicating a straightforward and conventional flotation pathway.

- Minerals containing deleterious elements were barely detected, supporting the potential for clean, high-recovery concentrates.

In the next set of testing, Copper Giant will optimize the reagents for both molybdenum and copper. GGNT plans to create a simulated flow sheet, and then a lock cycle, which is a more rigorous representation of a commercial processing facility.

Note: the above results are based on a single 130-kilogram composite and may not be representative of the full deposit. Additional variability and locked-cycle testing will be required.

“The Mocoa project keeps getting better,” stated Ian Harris, Copper Giant President & CEO in the October 2, 2025 press release. “These first metallurgical tests, under laboratory conditions, have already exceeded the recovery assumptions of 90% for copper and 75% for molybdenum used in our current resource model.”

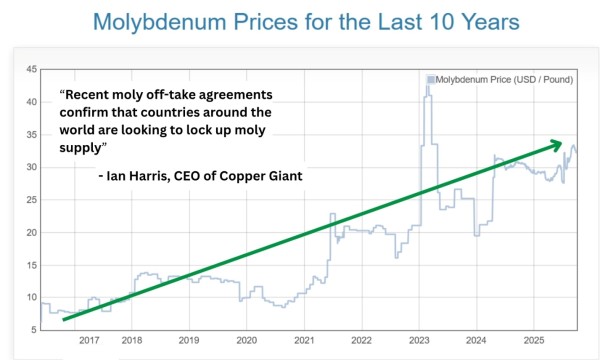

Primary uses for molybdenum include steel alloys, industrial tools, electrical contacts, high temperature applications and lubricants.

“Like copper, moly plays an important role in the green energy transformation,” said Harris told Guy Bennett, the CEO of Global Stocks News (GSN). “For instance, moly is used extensively in wind turbines, for structural components like towers and shafts, also in lubricants for turbine gearboxes and bearings.”

“Our resource model was based on $10/lb moly and $3/lb copper. Moly is now selling for about $25/lb, and copper is just under $5/lb. So, the projected future economics of the Mocoa project are changing radically.”

“These latest metallurgy results confirm there is a simple path to extracting the copper and mined rock,” added Harris.

https://www.dailymetalprice.com/metalpricecharts.php?c=mo&u=lb&d=2400

“With moly and copper demand, there’s a lot of geopolitics involved,” Harris told GSN. “We recently received a meeting request from the US embassy. I’ve worked in Latin America for 25 years, that’s never happened before.”

The US is an important trading partner with Colombia, with 2024 two-way trade of $36.7 billion.

“China announced it would restrict exports of five critical minerals: tungsten, tellurium, bismuth, indium, and molybdenum,” reported Exiger on February 12, 2025. “Industries dependent on these metals include defence, renewable energy, electronics, and manufacturing.”

In the weeks following China’s announcement, Greenland Resources inked a moly off-take agreement with Finland’s Outokumpu, the largest producer of stainless steel in Europe.

Almonty Industries also signed an off-take agreement to supply moly to a South Korea moly oxide smelter that has a deal with SpaceX.

“These recent moly off-take agreements confirm that countries around the world are looking to lock up moly supply,” Harris told GSN.

The US’s addition of molybdenum to its 2025 Draft List of Critical Minerals further amplifies this.

Investors are increasingly eyeing such assets, with recent sentiment highlighting molybdenum’s ‘perfect storm’ of shortages and strategic importance.

“With the October 2, 2025 metallurgy results confirming strong recoveries — up to 92% copper and 97% molybdenum — there is an opportunity for Copper Giant to play a significant role in meeting the global demand for copper and moly,” added Harris.

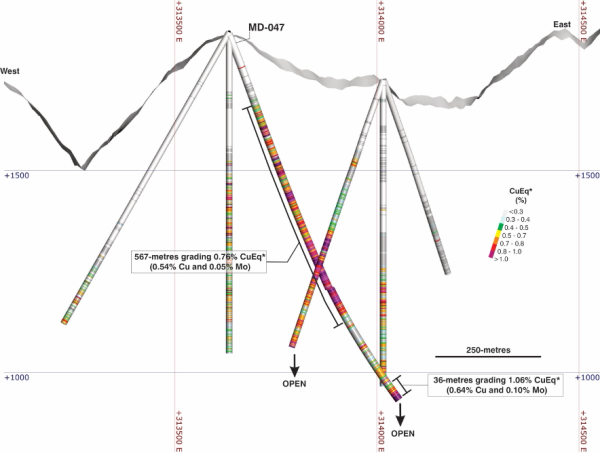

On July 30, 2025 Copper Giant reported that hole MD-047 returned 1,004-metres of continuous copper and molybdenum mineralization from surface with the entire hole averaging 0.57% CuEq* (0.39% Cu and 0.04% Mo), including 567-metres grading 0.76% CuEq* (0.54% Cu and 0.05% Mo) —highlighting one of the most robust mineralized intervals drilled within a porphyry domain at Mocoa to date.

“Beyond the exceptional grades, MD-047 gives us clear evidence of a broader and deeper high-grade system than we had modeled. Discovering new intrusive phases and ending the hole in strong mineralization, including a final interval over 1% CuEq, opens a new vector in the system,” stated Edwin Naranjo Sierra, Vice-President of Exploration.

* Copper equivalent (CuEq) for drill hole interceptions is calculated as: CuEq (%) = Cu (%) + 4.2 × Mo (%), utilizing metal prices of Cu – US$4.00/lb and Mo – US$20.00/lb and metal recoveries of 90% Cu and 75% Mo. Grades are uncut. Mineralized zones at Mocoa are bulk porphyry-style zones and drilled widths are interpreted to be very close to true widths.

Mining financier and philanthropist Frank Giustra has purchased an 11.2% stake in Copper Giant. In 2022, Mr. Giustra co-founded Aris Mining in Colombia. The company operates two underground gold mines, with Q2 2025 revenue of $200 million, up 75% from Q2 2024, driven by higher gold prices.

“I’ve been going to Colombia for over 30 years,” Giustra told Ceo.ca, “It is the only uninterrupted democracy in all Latin America. I’ve had nothing but success in Colombian oil & gas and mining. I have a home in Cartagena. I love the country, wonderful people, and the rule of law works.”

Mocoa remains open in all directions, with several satellite targets identified across the broader land package. These features support the interpretation of a district-scale porphyry system and position Mocoa as one of the most significant undeveloped copper-molybdenum assets in the Andes.

Edwin Naranjo Sierra, Vice-President of Exploration for Copper Giant, is the designated Qualified Person within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101”) and has reviewed and approved the technical information in this news release. Mr. Naranjo holds an MSc. in Earth Sciences and is a Fellow of the Australasian Institute of Mining and Metallurgy (FAusIMM). With respect to metallurgical procedures and results, the QP has relied on the qualifications of SGS-Peru and reviewed the data for reasonableness.

[1.] For further information refer to NI 43-101 Technical Report, entitled “Technical Report on the Mocoa Copper-Molybdenum Project, Colombia”, dated January 17, 2022, prepared by Michael Rowland Brepsant, FAusIMM, Robert Sim, P.Geo, and Bruce Davis, FAusIMM. with an effective date of November 01, 2021.

Contact: guy.bennett@globalstocksnews.com

Disclaimer: Copper Giant paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Media Contact

Organization: Global Stocks News

Contact Person: guy.bennett@globalstocksnews.com

Website: https://www.globalstocksnews.com

Email: Send Email

Country:Canada

Release id:35125

The post Geopolitics and Metallurgy put Copper Giant Massive Molybdenum Resource in Sharper Focus appeared first on King Newswire. This content is provided by a third-party source.. King Newswire makes no warranties or representations in connection with it. King Newswire is a press release distribution agency and does not endorse or verify the claims made in this release. If you have any complaints or copyright concerns related to this article, please contact the company listed in the ‘Media Contact’ section

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Just Examiner journalist was involved in the writing and production of this article.